Closing the ‘ABM gap’ in financial services

Account-Based Marketing (ABM) offers financial services firms a powerful way to deepen client relationships and achieve growth in a complex, competitive, and trust-driven industry. However, scaling it effectively is essential for long-term success.

ABM delivers results where it matters most: client growth. According to our research, 34% of financial services (FS) marketers report growth in existing accounts due to ABM – an advantage in an industry where client relationships are often built over decades.

At a recent Momentum ITSMA roundtable held in London, senior FS marketers discussed the realities of embedding ABM as a strategic growth driver. They identified several key challenges:

- Defining ABM: Differing interpretations of ABM within organizations creates confusion and misalignment.

- Measuring ROI: Leaders struggle to track ROI, making the business case for future investment difficult.

- Resource constraints: Lean teams and limited resources hinder progress, particularly during the transition from pilot programs to broader implementation.

- Tech infrastructure gaps: Early-stage programs often lack the necessary tools and data integration for effective scaling.

- Random acts of ABM: A lack of centralized governance (e.g. steering groups or a center of excellence) leads to fragmented efforts and inconsistent results.

Our Global Account-Based Marketing Benchmark shows that while 93% of FS marketers say they’re using ABM, many are stuck in the early stages, struggling to scale effectively. So why are so many firms still in the ‘experimenting’ phase – piloting programs and refining approaches – instead of delivering best-in-class ABM?

Pitfalls in scaling

Despite the initial success of and excitement around ABM pilots, scaling beyond those early wins remains a challenge. Firms often overlook critical elements in the rush to rollout larger programs. Pilots prove the concept, but scaling exposes the cracks.

Lack of sponsorship and governance: Many organizations treat ABM as a campaign rather than a long-term growth strategy. However, strong buy-in is critical for success. The roundtable participants revealed there was a gap in sponsorship and governance at their firms, signaling a clear need for greater accountability and strategic oversight.

Flawed account selection: ABM hinges on targeting the right accounts. Yet attendees showed a clear gap in processes and selection criteria when benchmarked against other companies. This leads to programs that lack focus and fail to deliver.

- Sales and marketing misalignment: We heard how sales teams need stronger evidence to be fully convinced of the impact of ABM, reflecting how disconnected goals and processes can undermine efforts. This is reflected in our ABM Benchmark study, where 53% of marketers cited misalignment as a key barrier to success.

Despite these obstacles, there are notable strengths. Many firms have made significant strides in performance optimization and personalization – ranking above benchmark companies. This progress will likely pay off: 36% of the marketers we surveyed reported stronger client engagement due to personalized ABM initiatives.

Becoming best-in-class

Our research shows that 36% of FS organizations have seen improvements in customer retention as a direct result of ABM – a key driver of long-term success in a market where customer loyalty is hard-earned.

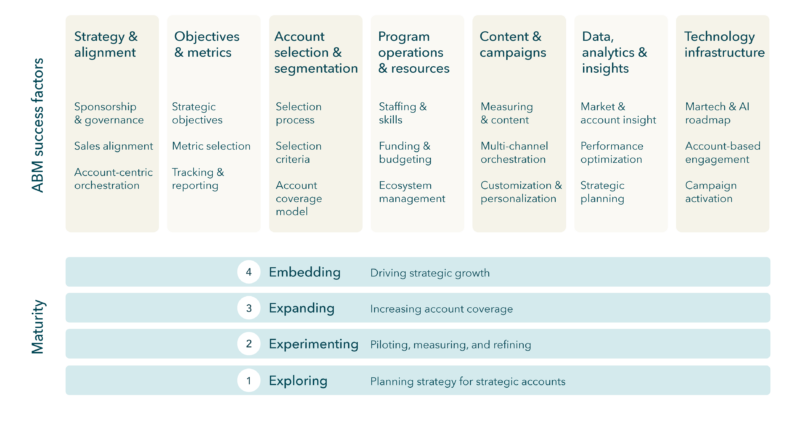

The Momentum ITSMA ABM Adoption Framework provides a roadmap for embedding ABM as growth driver within your organization. With four stages, seven foundational pillars, and 21 success factors, the framework outlines critical focus areas and offers actionable recommendations to guide you from experimentation to best-in-class execution.

Get in touch with andrew.rogerson@momentumitsma.com to explore the roundtable insights in greater detail and discover strategies to overcome the challenges of scaling ABM in your organization.

More in

-

How to interrogate a salesperson (cheat sheet)

I was recently asked this question: "I'm sitting down next week with a salesperson who's given me 30 minutes of their time. How do I make the most of this time? What questions should I be asking to tap into their account knowledge? What can I share in advance so they know what I'm after?"

-

Closing the ‘ABM gap’ in financial services

Account-Based Marketing (ABM) offers financial services firms a powerful way to deepen client relationships and achieve growth in a complex, competitive, and trust-driven industry. However, scaling it effectively is essential for long-term success.

-

Kyndryl: The born first ABM business

As organizations embed account-based strategies company-wide, Kyndryl is a rare example of a business that has embraced this approach from the outset.