Content: the long and the short of it

With the demand for fast information, and snappy opinions, easily digested on a mobile device, you would be forgiven for thinking that long-form content is no longer relevant.

Article

business strategy

Phil Brown

September 30, 2020

All too often, marketing departments embark on creating new go-to-market strategies, plans and propositions based solely on their tacit understanding of their customers and products. Whilst they may be very knowledgeable, it is difficult for marketers to keep abreast of all the moving parts which will impact how successful their proposition will be in the market. In our experience, it always pays to test your assumptions and obtain good insight before investing in major new campaigns and content.

Insight is one of those words that is often used but frequently undervalued. So what do we mean by insight, and why do we need it?

Insight is the value obtained from the analysis of information, which can be used to make better business decisions. It involves looking at available data and asking “Why is this relevant and what does it mean for our business?”

Without insight, we are frequently guessing and making assumptions. And although our assumptions may be intelligent and informed, we cannot have a high degree of confidence that we are on the right path unless we have up-to-date and relevant insight.

You don’t know what you don’t know! 72% of all new products end up failing, while 42% of failed start-ups were unsuccessful because their product or service didn’t address a real market need[i].The same is true with marketing messaging, where significant funds are committed to a new proposition only for it to fail to resonate with customers or stand out from the competition.

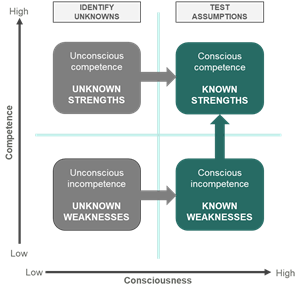

This is where the competence/consciousness matrix comes in useful.

This matrix highlights two areas where insight is needed to ensure a sound foundation for GTM plans:

The first is to identify “unknowns” – or blind spots – to ensure that you have a full picture of your relative strengths and weaknesses, bringing everything that it is relevant into your consciousness.

The second is to test the assumptions around what you think you already know. This is more than a simple ratification, but adds layers of insight such as which strengths are the most valuable to customers? Which are unique to us? Which weaknesses are the most critical to address to remain competitive? Crucially, the level of competence should be defined by your target audience and not by your own internal perceptions.

When developing new messaging for customers or partners, there are four main areas that we would recommend gathering insight from:

Customers/prospects (primary research) – it is always helpful to interview or survey customers or prospects to get insight straight from the ‘horse’s mouth’. It is essential to understand the buyers’ perspective in order to describe value from their point of view and make the messaging relevant to them.

Practical tip: This needs to be done in a structured, objective way to ensure that you get usable information and avoid introducing bias. The risk of internal people just having informal chats with customers is that you’ll hear what you want to hear and ignore the rest. In our experience, customers are more willing to open up if the interview is carried out by a third party and the feedback is handed over anonymously. Which is why many businesses use external agencies like OneGTM to conduct customer interviews on their behalf.

Internal stakeholders (primary research) – there is a lot of insight to be found within your own organisation, both inside and outside of the marketing team e.g. sales teams have a unique perspective on customer requirements as well as competitor strengths and weaknesses. Internal stakeholders can also provide proof points from past experience to help demonstrate credibility.

Practical tip: When identifying stakeholders to interview, think broadly about who might have something useful to contribute. It is often the people who work only tangentially to the project who have a more unique and interesting perspective.

Market analysts/publications (secondary research) – there are usually plenty of analysts and industry publications that can help you understand the trends, drivers and challenges relevant to specific market segments. In addition, there are reports that compare and contrast competitors (e.g. Gartner Magic Quadrants) which are very useful for finding your relative strengths and weaknesses.

Practical tip: This doesn’t need to involve purchasing expensive analyst reports. With some good desk-based sleuthing you can dig up a wealth of useful info from press releases, conference presentations and freely available papers. A note of caution: if you find great statistics and proof points in industry blogs, make sure you check for the original source…all too often they are taken out of context or are headline grabbers based on out-of-date research.

Competitors (secondary research) – although you can’t ask your competitors about their strengths and weakness, you can find out a lot by looking at their own messaging to identify what is different about you.

Practical tip: A useful method to compare competitors is to look at their positioning messaging and rank the attributes that they promote according to the level of emphasis that they place on them (e.g. are they leading with “customer service” or “technical innovation”?). In this way you can compare and contrast several competitors in more objective way.

A lot of our customers aren’t short of data, in fact information overload is sometimes part of the problem. But despite this wealth of information, they still lack what we would call “actionable insight”.

A key part of the Insight process is the analysis that looks at all the various sources of information, puts it into context, identifies the patterns and draws out what’s most salient. Only once it has been through this process can the insight obtained be put to good use in making better business decisions.

This step is critical to provide the platform for GTM planning or proposition development

A recent example illustrates the value of customer insight. We were asked by a B2B software provider to help them refresh their value proposition. When we spoke to internal stakeholders to understand their strengths and differentiators, they focused primarily on the clever features of their application, as well as its resilience and cloud-based delivery model.

Yet when we conducted interviews with their customers, we found that what they really valued – and for many had strongly influenced their purchase decision – were the intangible aspects of our clients’ offering. This included the ‘free’ consulting that they provided as part of the sales process, the tools and methodologies they provided to simplify implementation, and the ongoing support from dedicated ‘customer success’ teams.

Their existing messaging concentrated largely on the functionality of their application, and hardly mentioned these wrap-around service elements, despite the fact they were regarded as highly valuable by prospective and existing customers. By gleaning insights directly from customers, we were able to develop a story that was far more differentiated and compelling.

By gathering information from all of these sources, and turning it into actionable insight, you can work it into your go-to-market proposition to make sure that it is:

INFORMED: positions you as an expert with an understanding of the market environment

RELEVANT: the buyer will recognize how your proposition solves their business challenges

CREDIBLE: contains proof points and capabilities that underpin your ability to deliver

UNIQUE: is something that they can only get from you

Based on our experience working with many clients to deliver the insights needed to inform go-to-market strategies, we have come up with the following tips to maximize their value:

Tunnel vision is defined as the loss of peripheral vision. In humans, our peripheral vision may be less clear than our central vision but it is really good at detecting motion. By making sure that we look around us and take-in as much information from our surroundings as we can, we are able to be aware of more things, more quickly and therefore have more time to react.

The same is true with understanding our market environment. By following the guidance in this article, you will have more actionable insight and more time to react, making your go-to-market strategies much more likely to succeed.

If you want to find out about how Momentum ITSMA (formerly OneGTM) can help to deliver actionable insight into your go-to-market strategies, plans and propositions, please get in touch!

[i] Product Marketing Alliance https://productmarketingalliance.com/how-to-test-internal-assumptions/